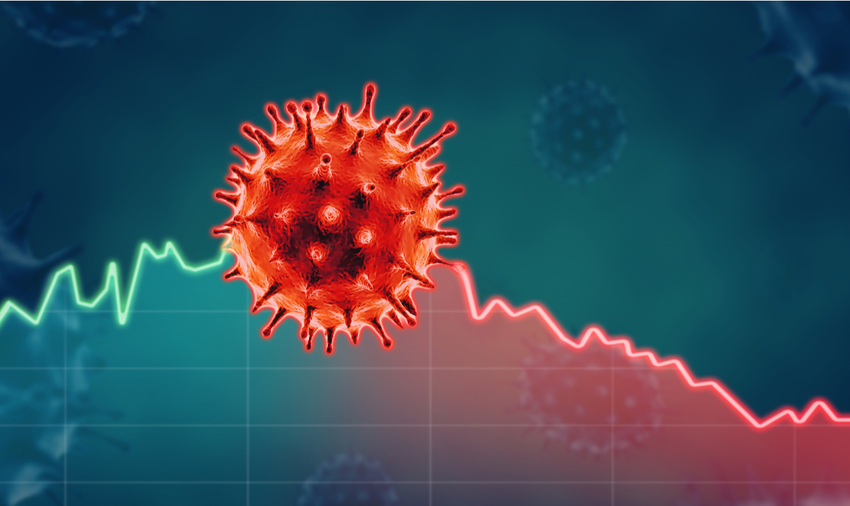

The world of economic policymaking will never be the same in the wake of COVID-19. This is not a typical recession stemmed from declining demand or supply but is rather a closure of economic activities — mobility of factors from, and return to, households and firms — by governments. Moreover, the pandemic is a public bad and the free-market system is yet to come to terms with such public bad. The orthodox solutions will not work. With providence and prudence, governments need to lead to respond the unmatched catastrophe.

The ending of the health emergency is uncertain and the massive economic fallout is unknown as the reopening of economic activities is indeterminate. Prior crises did not cause such devastations. For example, the current one inflicted more in just three weeks than those shattered in more than three years.

Governments, including that of Bangladesh, with varied magnitudes are injecting cash in the forms of loan guarantee schemes, reduced interest rates, forward guidance, financial stimulus, payment holidays, paying worker wages and tax breaks.

The mere injection of liquidity is not enough for the millions unemployed, underemployed and working poor. The decreased consumption because of unemployment will negatively impact the overall output, resulting in an additional unemployment, declined income and further under-consumption. The ceased production will also lead to supply repression, resulting in swelling unemployment, income erosion, and slackening off purchasing capacity. This is a nightmarish vicious cycle.

The new solution triumphs into policymaking after each crisis. The Great Depression was coined by the Austrian business cycle theorists who were at the helm of policymaking during the 1930s. They prescribed ‘leave-it-alone liquidationism’ for the failed investment and businesses without aggressive actions, believing in Say’s law, the production is source of demand and the equilibrating powers of the market. Challenging the view, Keynesians espoused that expansionary fiscal policies needed to stave off regressing autonomous spending. Decades later, a counter-revolution by the monetarists stated that the Great Depression resulted from the shrinking supply of money, asserting aggregate money supply is equivalent to national output. They reigned for decades relying on monetary policy, with inflation targeting and leaving hardly any role for fiscal policy sans balancing the budget.

The financial crisis of 2008 heralded ‘new consensus’ with quantitative easing, the injection of money in exchange for bonds as the prime policy instrument and austere fiscal policy in the name of ‘sound finance.’ This, however, denies that the crisis is due to an endogenous functioning of financial system. Moreover, such largesse benefited rentiers.

The current crisis begs a new framework. More so, certain countries have already been plagued with challenges that existed before the pandemic. For example, in Bangladesh, the ratio of private investment to gross domestic product has remained stagnant for more than a decade, with illicit outflows being on the rise. The rate of unemployment has soared despite the growth in the GDP. The growth of real wage has decreased. The rate of reduction in poverty also plummeted due to lesser employment and drop in return on labour. Inequality is also mounting. The public expenditure is compromised due to poor mobilisation of revenue, impacting social sectors negatively. The waning revenue has forced the government to resort to heavy borrowing from banks and crowding out private investments and subsequent liquidity crisis. The overrun of mega projects escalated costs. The weakening rates of growth in export and import and declined remittances are worrying. The quality gaps, disparities and low public spending distressed education and health sectors. The existing social safety net programmes are not universal, inadequate and ineffective, with low coverage.

Principles of new framework

AGAINST such backdrop, the core of policymaking in a legitimate state is to provide for fundamental needs of citizens. In Bangladesh, the fundamental pillars — equality, human dignity and social justice — are enshrined in the proclamation of independence. The state, thus, needs to transform to a citizens’ state, armed with an appropriate framework. Some constituent principles of the framework are discussed below:

Investment in use value: COVID-19 points out public goods provision failure in health, social security, etc because of underfunding in use value generating public provisioning. This derives from a misconstrued ideology that market is the organising principle and society is equivalent to market. Rather market is subordinated to social, political and cultural norms. The use-value producing public goods is indispensable for augmenting capabilities of citizens to transform economic structure, political settlement and organisation of society.

Decent living for everyone: The world agreed to leave no one behind, committing realisation of the Sustainable Development Goals. A fully-fledged life-cycle-based social security system is needed to achieve these goals. The universal system has to include, amongst others, income support, national health services, child benefits, housing benefits, disability living allowance, invalid care allowance, state pension, job seekers’ allowance. These will alter lives of people mired in poverty and working in informal sectors.

Multiplier effects generating public spending: The public spending — the money of the public — shall only be allocated to create multiplier effects in an economy, provide public goods and address externalities — negative and positive. The public spending is not meant for a few at the expense of many — clientelistim must be checked. A plenty of holes, including hefty capacity charges given to power plants, has to be stopped. Incentives should only go to employment-generating real sectors, with minute details such that enterprises matter, but it is job that counts.

Mission oriented policies: Mission oriented policies can create multiplier effects as well as accelerate growth. For example, technological catching up, particularly in this age of Fourth Industrial Revolution, is a much sought mission to enhance productivity and gain competitiveness. A nationwide rural area regeneration industrial scheme is a good candidate. Such super multipliers can accelerate all — aggregate demand, consumption, investment and net-exports.

Transformative production pathway: Pushing economy to the next rungs as the country aspires to be a middle-income and eventually a developed country, requires a transformative production pathway, ensuring a cleaner, greener and stable production system. This necessitates a green new deal and well-being of both human and nature. Adopting such production system will address creeping impacts of climate change and reduce biodiversity degradation.

Citizenship for sustainability: The transformation of an economy also entails an active citizenship as a sufficient condition, which can only claim accountability of the state and ensure a command over authorities and public resources. Only then public finance transforms to be of the public, by the public, and for the public. For example, the budgetary control in Bangladesh is exclusively with the executive, with little checks and balances and, thus, the constitution requires amendments.

Proposed elements of monetary policy

THIS is the need of the hour for harmonisation of fiscal and monetary policies. The macroeconomic policies have to play both stabilisation and developmental roles. Fiscal, monetary and banking policies should be counter rather than pro-cyclical, willing to use instruments other than the regular monetary ones to attain these objectives.

There is a much hue and cry that the injection of money, including new issuance, will augur inflation. There is no possibility of a runaway inflation, even in Bangladesh, given the current depressed consumption spending and slackened production. Price inflates when nominal spending surpasses real capacity of producing goods and services in an economy. There is no denying if injecting cash and going for the issuance of new money, if needed, to curb the contraction as money is a creature of a state at all times. The interest rates can also be adjusted on a gradual basis, reflecting the need, without worrying too much about inflation.

The packages announced in Bangladesh requires further working out. During the initial phase of the crisis, the credit flow will be slow to trickle down, given the existence of pre-crisis liquidity shortage. Banks have to be activated, with aggressive measures and continuous surveillance to increase credit to all stakeholders, transcending beyond the current bias in favour of chosen organised sectors, limited in numbers vis-à-vis vast informal agriculture, manufacturing and services.

Banks will not be willing to serve small and medium enterprises because of higher administrative cost vis-à-vis large enterprises, with the same rate of interest, warranting an additional service charge to the banks from the exchequer to incentivise them to reach out the SMEs. Mere injection of loans may further pressure on the balance sheets as debt is a liability, meriting direct relief from the government for the needy firms.

The central bank has to create more specialised windows. For example, micro-finance borrowers will default. To keep them afloat, a further inflow of liquidity and debt relief is desirable. The central bank, in consultation with the microfinance regulatory authorities, has to institute a window for debt relief and availability of liquidity to banks at a lower rate to lend microfinance institutions. For the agricultural loans, a facility of debt relief and injection is a cry of the day.

Given that some banks’ overexposure in advance-deposit ratio and deposit to banks may not increase in near future, the central bank can opt for a working capital taka loan window and need-based statutory liquidity ratio and cash reserve ratio requirements for a short-term.

Given the excessive pre-crisis defaulted loans, a debt restructuring agency is long overdue to take over such loans from banks for management and restructuring. Additionally, the cheaper and subsidised credit should not flow to the firms, which have benefited from ‘one-time exit facility’ to reschedule the defaulted loans, written-off and cases pending before the court.

The central bank along with the government may negotiate with governments of exporting countries for payment holidays for imports. The central bank can opt for usance letters of credit, instead of sight letters of credit, requiring to pay immediately and may consider for a facility to pay for import.

Another objective would be to ensure stability in the exchange rate to avoid disruption in trade flows. A selective capital control measures to discourage speculative trading can also be introduced. For maintenance of adequate supply of foreign exchange, negotiations should be initiated with the IMF and other multilateral organisations for relief and suspension from debt servicing and additional grants for budgetary support.

The central bank must step in to finance stimulus package of the government in local currency as this would have a lesser effect on debt burden.

Suggested fiscal policy framework for Bangladesh

THE authorities need to embark on a short-, medium- and long-term strategy as the announced package hardly mentions fiscal policy measures as regards social security, real sectors and social development. The following can be considered in the next budget:

The prime focus of the new fiscal policy has to be on employment, particularly in view of erosion of income and unemployment, aggravated by pre-crisis high unemployment and underemployment due to jobless growth and shortages in skills. For this moment, arbitrary government deficit and debt ratios are inappropriate focus.

The stimulus has to reach workers in informal sectors and poor households through social security system and public investment in health and education sectors, on the one hand, and the real sectors which have potential to generate new employment and preserve the existing employment, on the other. This is a departure of focusing only on raising aggregate demand and if policymaking is not changed in such direction, the economy will be limping, with knock-on effects on social stability.

The current crisis points out plight of day-wagers, who are, unfortunately, the significant majority, with vast amongst them are either poor or working poor. For their living, establishment of a universal social security system — at least to pay for above the international poverty line — is an obligation. Such system must include universal pension allowance, jobseeker’s allowance, disability living allowance, child benefit, housing benefit, income support allowance and health allowance. An initial estimate, by the author for these seven allowances, may cost the exchequer Tk 1,515 billion, 5.48 per cent of the GDP. This is not an impossible task as many developing and developed countries spend more than 11 per cent of the GDP on social security and money can be poured in from loopholes such as capacity charges, cost overruns, bureaucratic largesse, besides adding the existing 743 billion spent on social safety nets.

COVID-19 is a glaring example of public goods provisioning failure. The health sector has been on a sick bed because of trivial budget allocation, inadequate equipment, infrastructural deficiency, low-quality service and high out-of-pocket expenditure because of the intransigent elite’s abandonment and health seeking abroad. The solution lies for a national health services for all in the medium term. In between, health allowance should be provided for the needy and the required amount is included in the abovementioned social security budget. Further spending is desirable for the endowment of a general physician for each person. Referral procedures is indispensable to ensure health care, which in turn will require more physicians and nurses. This would require less than 6 per cent of the GDP.

Access to quality education is captivated by a particular class as universal education has not been launched, resulting in a massive supply shortage of skills. The tertiary education is not working, failing to generate knowledge, develop skills and create citizenship. A transformation warrants government spending of 5.99 per cent of the GDP.

The real sector has been at risk before the outbreak. The export growth rate has been negative in addition to failures of diversifying products and markets. Manufacturing has been held back by lack of business confidence. While farmer’s profitability has declined because of a rise in input prices, no breakthrough in agriculture as regards innovation and technological advancement in the post-green revolution period is noticed. The service sector is facing shortage of skills supply. The dearth of skills has led to the hiring of documented and undocumented workers from abroad, resulting in a colossal outflow. The continuous sunk in remittance is a serious concern, particularly for rural households.

The fiscal measures such as grants, tax breaks, holidays and exemptions need to follow a functional approach like a patient treated in the intensive care unit according to the need. A detailed sector-by-sector potential has to be worked out. The incentives and subsidies to firms must be on outcome based, focussing criteria such as employment creation, diversification, value addition, greening and import substitution, with emphasis on SMEs. A stringent disciplinary approach against clientelistic networks is obligatory due to their tendency of capital flight by amassing incentives, instead of investing into competitiveness, productivity and technological advancement.

As regards agriculture, the emphasis is to be on maintenance of the production cycle. The government, therefore, needs to make a special scheme to buy agricultural products directly from farmers as the country is proceeding towards harvest, which will signal confidence. The government may encourage the farming of food such as cereals, oil seeds, poultry, cattle, cows and fisheries to ensure food security by providing subsidies, besides debt relief and injection of new loans.

Three mission-oriented equity matching facilities — the green industrialisation fund, the diversification fund and the nationwide rural area regeneration industrial fund — can be established to address the massive changes in the post-COVID era. The SMEs and start-ups should be prioritised with key performance indicators whilst stringent conditionality has to be imposed on large firms to access such funds. Each disbursement will entail meeting benchmarks to avoid experiences of sick industries and debt default. To curb high underemployment and shocks due to lesser outmigration in rural areas and concentration of industrial activities in a few centres, the nationwide rural area regeneration industrial fund can finance an integrated solution, comprising industrial plots, utility services including gas, electricity etc along the national highways and waterways. This will create growth centres across the country.

There is an established link between ecological destruction and the spread of diseases such as COVID-19. An immediate moratorium on the diversion of natural ecosystems, including forests and wetlands, for mining, infrastructure, and other ‘developmental’ projects is crucial.

There is a need to strengthen local self-governance to its fullest extent for realisation of a people’s democracy. Legal amendments are necessary to transform the existing ones to local self-government along with provision of resources, skills and cooperation to grow their own local economies, catering to local needs.

Actions at multilateral level

Since all countries are committed to realising the SDGs, they need to move ahead transcending beyond anachronism and divisiveness. Only the contagion of cooperation can pave the way for the future. This requires an immediate action of the magnitude of Marshall Plans and Manhattan Project by multilateral organisations including the United Nations, the IMF and the World Bank to stave off cascading crises. Developing countries require injection of money, grants and debt relief. The announced funds by different organisations till this date are inadequate, given the enormity and complexity of the pandemic.

Sustaining public trust by government and multilateralism is crucial for solidarity amongst citizens for a shared prosperity and social stability. The time is of essence to take bold actions to arrest the downturn and move towards a sustainable pathway.

First published in new age.

Thumnail Source: Sciencepo.fr